Services

Our Features

Our Featured products.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Personal Banking

From simple, secure Current and Savings Accounts for everyday needs, to specialized Youth and Student options designed to kickstart financial independence, we have a solution for everyone.

Agricultural Banking

Specialized financial services for the agricultural sector. Access flexible Farmer’s Loans, long-term Agric Funding for expansion, and high-yield Commercial Farms Saving Schemes to ensure financial stability and resilience.

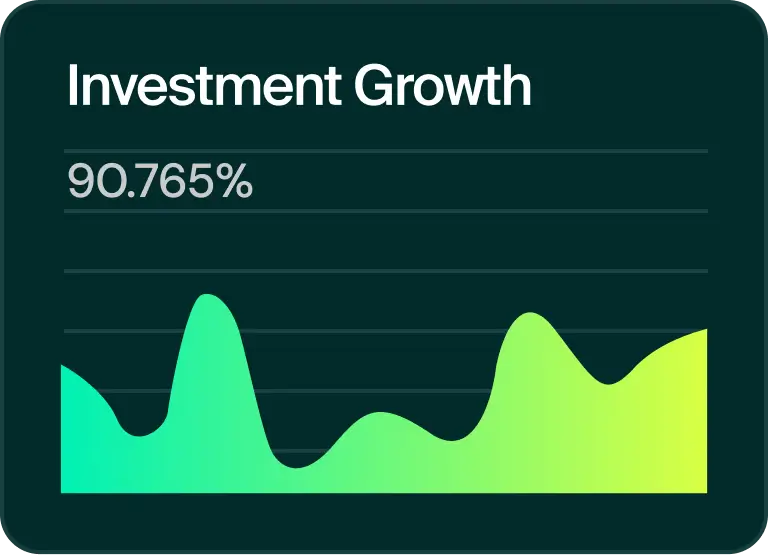

Investment & wealth solutions

We offer powerful strategies for building, protecting, and growing your wealth, featuring Fixed Deposits, Real Estate Investment Funds, and tailored Property Investment Plans.

Community & Social Solutions

We provide targeted financial resources—including Women Empowerment Funding, School Start-Up Funds, and essential School Fees Loans—to drive social mobility and build sustainable local futures.

A Full Spectrum of Services

Save

Get a loan

Buy a house

Build & pay slowly

Create Your Account in 4 Easy Steps

Visit Our Bank

Lorem Ipsum is simply dummy text of the printing and industry.

Get Verified

Lorem Ipsum is simply dummy text of the printing and industry.

Start Saving

Lorem Ipsum is simply dummy text of the printing and industry.

Start Saving

Lorem Ipsum is simply dummy text of the printing and industry.

Have any questions?

What is Afri-cub

Afri-CuB is a modern African financial institution designed to empower Africans to build, own, and secure their financial future. We go beyond traditional banking by serving as a dedicated partner in wealth creation and community development.

What services do you offer

Personal Banking: Tailored solutions for individual financial growth.

Agricultural Banking: Specialized support for the farming and agribusiness sectors.

Investment & Wealth Solutions: High-yield Fixed Deposits and Property Investment Plans.

Community & Social Solutions: Programs designed to drive social impact and economic empowerment.

How can i open an account

Visit any of Our offices located at Limbe, halfmile and Buea

How can I invest with Afri-CuB?

We currently offer two primary investment pathways:

Fixed Deposits: Secure accounts designed for financial stability and growth.

Property Investment Plans: Personalized plans to help you acquire and secure real estate assets for generational wealth.

Is Afri-CuB regulated?

Yes. Afri-CuB operates as a modern financial institution in full compliance with regional financial regulations. We work closely with regulatory bodies to ensure that all investment products—from Fixed Deposits to Property Plans—meet the highest standards of legal and financial oversight.

Why does a bank host a Festival and an Awards ceremony?

At Afri-CuB, we believe that “Africa’s rise begins with ownership.” Ownership isn’t just financial; it’s cultural and intellectual. The Afri-CuB Festival and Awards are our way of investing in the people and the culture that drive economic growth, creating a holistic ecosystem where business and community thrive

How does Afri-CuB contribute to the local economy?

Beyond banking, we reinvest a portion of our operational surplus into local community projects, agricultural grants, and the Afri-CuB Awards to stimulate grassroots innovation. We believe our success is tied directly to the prosperity of the communities we serve.

Get Started, Visit Us Today.

Register Now and Get 15% off registration

Ready to secure your financial future? Stop by any of our local branches to register for an account and begin your investment journey. visit any of our branch to start